In recent months, prospective homebuyers have faced a significant challenge to becoming homeowners: higher mortgage rates. If you’ve been thinking about buying a home, this is something you’ve undoubtedly been paying attention to. While today’s rates are certainly influencing the market, there are still opportunities for homebuyers.

Many buyers are waiting for mortgage rates to come down

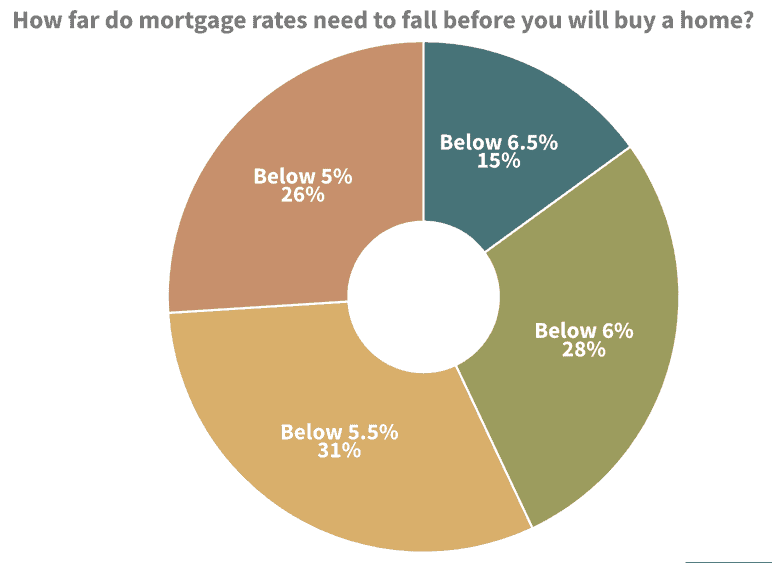

Recently U.S. News ran a nationwide survey of Americans who are planning on buying a home in 2024. The survey found that 67% of respondents are waiting for mortgage rates to drop before buying. It also found that 85% of buyers were waiting for rates to fall below 6%.

If you’re tracking mortgage rate changes, you know those homebuyers won’t stay out of the market forever. Mortgage rates have come down off their peak last October. And while there’s still day-to-day volatility, longer-term projections show that rates should continue to drop, as long as inflation gets under control. Some experts are even predicting rates will drop to below 6% by the end of the year.

As mortgage rates start to drop, we can expect to see an increase in inventory. And this uptick in inventory, combined with decreasing mortgage rates, will cause the buyer floodgates to open. All those buyers that were waiting for more favorable market conditions will enter the market, which likely means multiple offer situations and higher home prices.

Homebuyers need to be strategic when it comes to mortgage rates

If you’re considering entering the housing market, the current climate presents a strategic dilemma. Waiting for potential future decreases in mortgage rates might seem like a prudent choice, but there are compelling reasons to consider buying sooner rather than later.

Right now, competition for homes is lower. This means buyers may find better deals and be able to negotiate seller concessions on desirable properties. Additionally, entering the market now with the intention of refinancing if and when rates drop could provide a viable pathway to long-term affordability.

Historical data also shows that real estate tends to appreciate over time, providing a buffer against fluctuations in mortgage rates. For those with the financial stability to make a move, buying now might not just be a viable option—it could be a strategic advantage.

Waiting for pandemic-era interest rates is a mistake

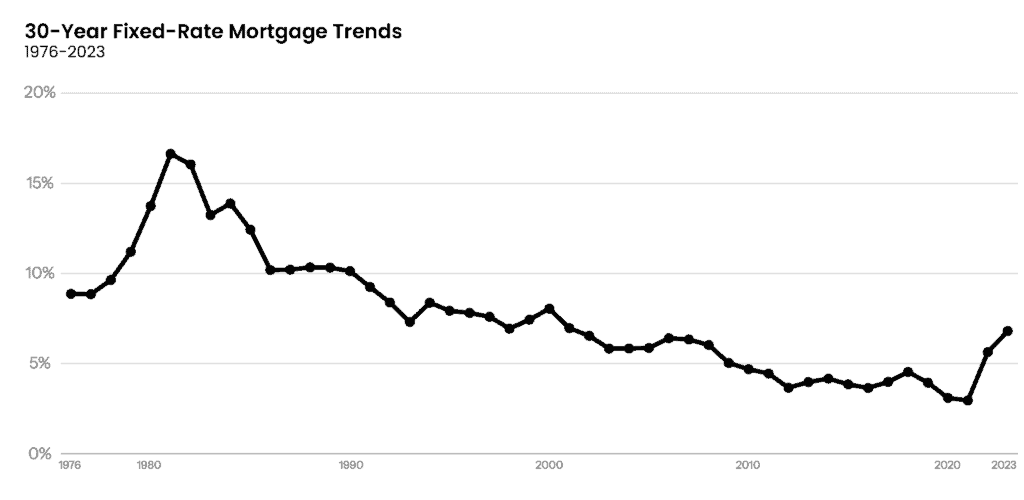

In 2021, the average cost of a 30-year fixed-rate loan was 2.8%. These low rates were driven by unprecedented global economic conditions and monetary policy responses to stimulate the economy. But here’s why we don’t want to see that happen again and why waiting for those rates to return is a big mistake.

First, according to Federal Reserve economist Claudia Sahm, the U.S. economy would need to fall into “a severe recession” to see rates that low. Sahm said that “when they’re really low, that means something bad has happened.” Second, it’s unlikely rates would fall to those levels, even with a recession or other economic depressant. Jacob Channel, senior economist at LendingTree, suggested that such record lows are unlikely to be seen again in our lifetimes.

Waiting indefinitely for lower rates will likely result in missed opportunities. Historical data and recent trends suggest that housing prices will continue to rise, potentially offsetting any savings from waiting for a lower interest rate. Furthermore, as the market adjusts, the overall cost of waiting, including potential rent payments and the loss of home equity growth, could surpass the benefits of lower rates.

So what should potential homebuyers do about mortgage rates?

If you want to enter the housing market and you’re concerned about mortgage rates, you need to be working with a professional mortgage lender and an experienced real estate agent. A good mortgage lender will be able to show you multiple lending scenarios to help you navigate the current market conditions and plan accordingly for your future. These scenarios can include various types of mortgage products, different down payment options, and the potential impacts of rate changes over time. A quality lender will also offer guidance on locking in rates at the right moment, potentially saving you thousands over the life of your loan.

A good agent will help you identify opportunities and structure deals to include credits to potentially buy down rates or offset out-of-pocket expenses.